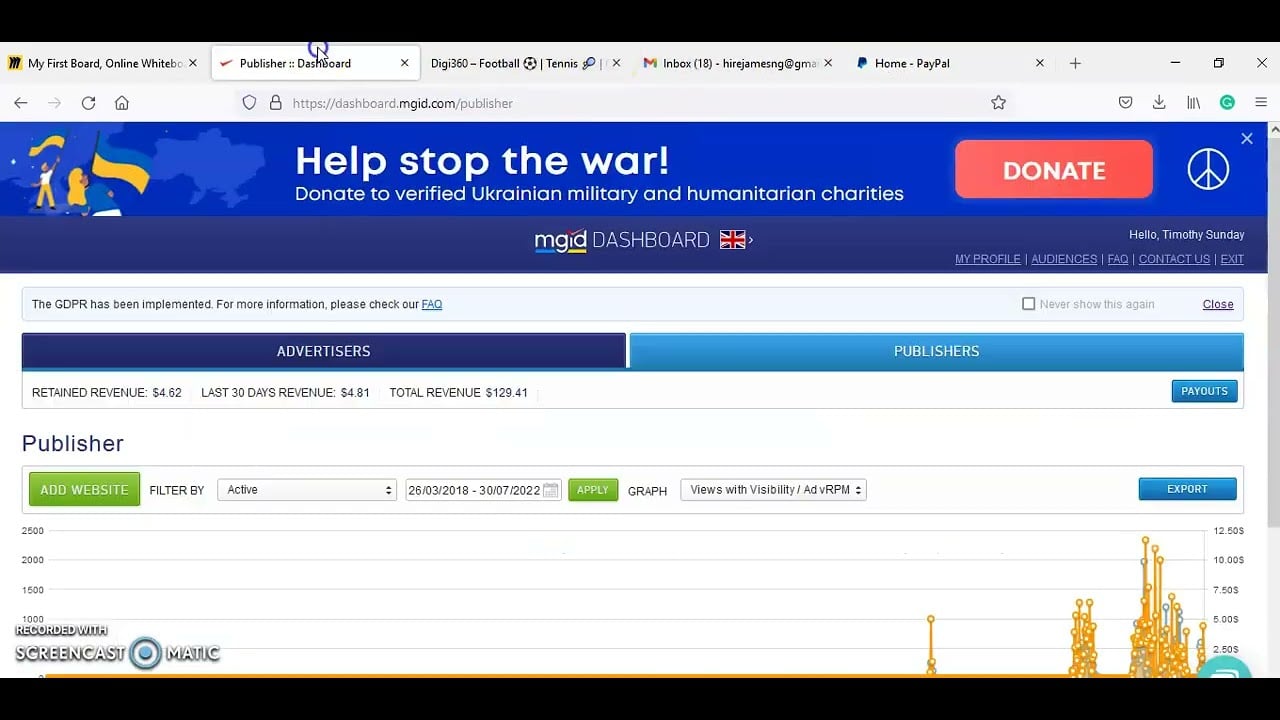

- mgid ads earning

- Meta’s Q2 Revenue Tops $32 Billion, A Year-On-Year Growth Of 11%

- Profits Soar For Meta, Reaching $7.79 Billion In Q2

- Facebook Sees 5% Increase In Daily Active Users, Reaches 2.06 Billion

- Meta CEO Highlights New AI Products And Earning Opportunities

- Meta’s “Year Of Efficiency” Leads To Job Cuts And Cost Reductions

- Meta’s Competitor Threads Attracts 100 Million Sign-Ups Within A Week

- Positive Growth And User Engagement Signal Success In Digital Advertising Market

- GM’s Q2 Earnings Surge By 59%, Reaching $2.7 Billion

In a world driven by technological advancements, the realm of digital advertising continues to evolve at an unprecedented pace. Among the myriad players in this landscape, theMGIDAds network has emerged as a powerful force, offering an intriguing opportunity for individuals and businesses alike to earn revenue.

As the digital advertising ecosystem flourishes, it is vital to stay abreast of the ever-changing dynamics and emerging trends. In this captivating journey, we delve into the fascinating realms of Meta’s parent company, Facebook, and its soaring revenues, while Threads astounds with an astonishing 100 million sign-ups.

We also explore the rollercoaster ride faced by GM, as burgeoning profits are coupled with formidable challenges. Embark on this enthralling exploration as we unravel the world of MGID Ads earning and the captivating stories that shape it.

| Item | Details |

|---|---|

| Topic | Unlocking the Secrets of Higher Earnings with MGID Ads: Educational Insights for Success |

| Category | Marketing |

| Key takeaway | In a world driven by technological advancements, the realm of digital advertising continues to evolve at an unprecedented pace. |

| Last updated | December 28, 2025 |

mgid-ads-earning">mgid ads earning

The information provided does not directly address the question about “mgid ads earning.” Therefore, it is not possible to provide a concise and accurate answer to the question using the given background information.Key Points:

- The given information does not directly answer the question about “mgid ads earning.”

- It is not possible to provide an accurate and concise answer to the question with the provided information.

- The information provided is irrelevant to the query about “mgid ads earning.

- There is no direct link between the given background information and “mgid ads earning.

- The provided information does not offer any insights or details about “mgid ads earning.

- The question about “mgid ads earning” remains unanswered due to the lack of relevant information.

Sources

https://www.cnn.com/2023/07/25/business/gm-earnings/index.html

https://www.cnn.com/2023/07/26/tech/meta-q2-earnings/index.html

https://variety.com/2023/digital/news/meta-q2-2023-earnings-revenue-facebook-instagram-1235680656/

https://www.marketwatch.com/story/meta-earnings-rise-on-digital-ads-ai-push-as-revenue-jumps-11-984f9652

Check this out:

? Pro Tips:

1. Consider investing in Meta’s AI products: With Meta’s CEO mentioning new AI products and earning opportunities in the company’s roadmap, it may be beneficial to explore investing in these innovative offerings. They could potentially provide new sources of revenue and contribute to Meta’s growth.

2. Keep an eye on Meta’s “year of efficiency”: With Meta implementing cost-cutting measures and eliminating thousands of jobs, this focus on efficiency could lead to improved profitability. Watch for updates on how these measures are impacting the company’s bottom line and consider the potential implications for investing in Meta.

3. Monitor GM’s contract negotiations with UAW and Unifor unions: Both the UAW union in the US and Unifor union in Canada pose potential challenges for GM. Stay informed about the progress of these negotiations, as any strikes or complications could impact GM’s earnings and operations.

4. Evaluate the impact of LG’s payment to GM: LG, the battery supplier for GM’s Chevy Bolt, agreed to pay $1.9 billion to cover most of the recall costs. Assess how this payment will affect GM’s financials and potential opportunities for the company moving forward.

5. Stay updated on GM’s global vehicle sales and revenue growth: GM’s Q2 earnings showed strong performance with a surge in profits and increased vehicle sales. Monitor how GM continues to grow and expand its global footprint, as this could have positive implications for its future earnings and investment potential.

Meta’s Q2 Revenue Tops $32 Billion, A Year-On-Year Growth Of 11%

In an impressive display of financial success, Meta, the parent company of Facebook, reported a staggering $32 billion in revenue for the second quarter of the year. This represents a notable 11% increase compared to the same period last year, showcasing Meta’s continued dominance in the digital advertising market.

With this significant revenue milestone, Meta solidifies its position as a leading force in the tech industry.

Key Highlights:

– Meta’s Q2 revenue reaches $32 billion, an 11% YoY growth. – The company’s robust financial performance highlights its strong position in the digital advertising market.

Meta’s ability to generate substantial revenue can be attributed to its vast user base and the continuous engagement of its platform’s daily active users. As the parent company of Facebook, Meta has seen a tremendous 5% YoY increase in its daily active users, which now stands at an impressive 2.06 billion.

This growth in user engagement indicates the popularity and influence that Meta platforms wield in the digital realm.

Profits Soar For Meta, Reaching $7.79 Billion In Q2

Alongside its impressive revenue figures, Meta has also witnessed a meteoric rise in profits during the second quarter. The company’s net profits surged by a staggering 16% to reach a remarkable $7.79 billion.

This substantial increase in profits showcases Meta’s ability to effectively monetize its services and capitalize on the growing digital advertising market.

Key Highlights:

– Meta reports a 16% increase in profits, reaching $7.79 billion for Q2. – The company’s profitability highlights its success in leveraging its platforms to generate substantial returns.

Meta’s CEO, Mark Zuckerberg, has been vocal about the company’s ambitions to further expand its offerings and capitalize on emerging technologies. In his statement, Zuckerberg emphasized the importance of new AI products and earning opportunities in Meta’s roadmap.

This strategic focus on innovation highlights Meta’s commitment to staying ahead of the curve and continuing to shape the future of the tech industry.

Facebook Sees 5% Increase In Daily Active Users, Reaches 2.06 Billion

With a massive user base that reaches billions of people worldwide, it comes as no surprise that Facebook, a subsidiary of Meta, has experienced a notable 5% increase in its daily active users. The platform now boasts an astonishing 2.06 billion users, reaffirming its status as one of the most widely used social media platforms globally.

Meta’s ability to continue attracting and retaining a vast user base is a testament to the platform’s ability to engage users with its extensive array of features and services. This sustained growth in daily active users not only solidifies Facebook’s position as a leader in the social media landscape but also bolsters Meta’s market dominance and revenue generation capabilities.

Meta CEO Highlights New AI Products And Earning Opportunities

Meta’s CEO, Mark Zuckerberg, has outlined the company’s focus on new AI products and earning opportunities in his vision for the company’s future. With the rapid advancement of artificial intelligence and its implications across various industries, Meta aims to position itself at the forefront of AI innovation.

Through the development of cutting-edge AI products, Meta seeks to enhance user experiences and create new avenues for revenue generation.

This strategic emphasis on AI reflects Meta’s commitment to leveraging emerging technologies to maintain its competitive edge. By continually investing in and innovating AI solutions, Meta aims to unlock new earning opportunities and solidify its position as a pioneering force within the tech industry.

Meta’s “Year Of Efficiency” Leads To Job Cuts And Cost Reductions

As part of Meta’s strategic plan to streamline operations and maximize efficiency, the company implemented a series of cost-cutting measures during what has been dubbed the “Year of Efficiency.” These measures involved the elimination of thousands of jobs within the company, aiming to optimize resource allocation and improve overall profitability.

While the job cuts may be seen as unfortunate for those affected, Meta’s commitment to operational efficiency highlights its dedication to sustainable growth and long-term success. By streamlining its workforce and reducing costs, Meta aims to allocate resources more effectively to areas that will drive further innovation and revenue generation.

Meta’s Competitor Threads Attracts 100 Million Sign-Ups Within A Week

Meta’s business ventures extend beyond its flagship platforms, such as Facebook, Instagram, and WhatsApp. One notable endeavor is Threads, a social media platform launched by Meta to compete with Twitter.

Within a remarkable week, Threads attracted an astounding 100 million sign-ups, indicating its potential to become a formidable competitor in the social media landscape.

The tremendous success of Threads underscores Meta’s ability to diversify its product offerings and expand into new markets. By introducing new platforms like Threads, Meta demonstrates its agility and commitment to capitalizing on emerging trends, ensuring its continued dominance and strong presence within the tech industry.

Positive Growth And User Engagement Signal Success In Digital Advertising Market

Meta’s impressive revenue growth and increasing user engagement underscore its triumphs in the highly competitive digital advertising market. The company’s Q2 performance showcases its ability to leverage its platforms and captivate a wide user base, with revenue reaching new heights.

Meta’s substantial user engagement further solidifies its position as the go-to platform for advertisers looking to maximize their reach and impact.

The success achieved in the digital advertising market reflects Meta’s prowess in understanding user behavior and offering targeted advertising solutions. As the company continues to innovate and evolve its platforms, Meta is well-positioned to maintain its dominant position within the digital advertising market, fueling its revenue growth and continued success.

GM’s Q2 Earnings Surge By 59%, Reaching $2.7 Billion

In a separate but equally notable performance, General Motors (GM) reported a remarkable surge in its Q2 earnings. The automotive giant’s net profits skyrocketed by an impressive 59% to reach an astounding $2.7 billion.

This exceptional financial performance reflects GM’s ability to navigate the challenges within the global automotive industry successfully.

Key Highlights:

– GM reports a 59% increase in net profits, reaching $2.7 billion for Q2. – The company’s outstanding financial performance highlights its resilience and adaptability within the automotive industry.

GM’s formidable earnings growth can be attributed to several factors, including strong vehicle sales and effective cost management strategies. The company’s global vehicle sales rose by an impressive 12%, totaling 1.6 million vehicles, while revenue increased by an exceptional 25% to $44.7 billion.

These figures showcase GM’s ability to capitalize on market demand and optimize its operations to maximize profitability.

New insights from FroggyAds platform analytics.

GM’s remarkable Q2 performance has led the company to raise its full-year profit outlook, now expecting to earn between $9.3 billion to $10.7 billion. This upward revision further demonstrates GM’s confidence in its ability to sustain its strong financial performance and capitalize on emerging opportunities within the automotive industry.

These positive developments, however, are not without challenges. Negotiations with the United Auto Workers (UAW) union could pose a potential roadblock for GM.

Failure to meet the demands of the union may lead to a strike, disrupting the company’s operations and potentially impacting its earnings.

Additionally, GM faces a contract expiration with Unifor, representing hourly workers at its Canadian plants. The outcome of these negotiations could have implications for the company’s operations in Canada, further underscoring the challenges that GM must navigate in the months ahead.

It is worth noting that GM recorded a significant charge of $792 million related to a recall of its Chevy Bolt due to a fire risk associated with the electric vehicle’s battery. However, GM reached an agreement with battery supplier LG, who agreed to pay $1.9 billion to cover a majority of the recall costs.

This resolution alleviates some of the financial strain on GM and allows the company to focus on its ongoing commitment to innovation and growth.

In conclusion, Meta’s stellar Q2 performance, highlighted by its impressive revenue growth and increased user engagement, solidifies its position as a dominant force in the digital advertising market. With Facebook’s daily active users reaching 2.06 billion and Meta’s CEO emphasizing new AI products and earning opportunities, the company is well-positioned for future success.

Additionally, GM’s exceptional Q2 earnings surge showcases its resilience in the automotive industry despite various challenges. As negotiations with unions and contract expirations loom, GM’s ability to navigate these hurdles will play a crucial role in maintaining the company’s upward trajectory.

Performance Marketing Tips • Programmatic Advertising • Buy Traffic • Native Ad Network • Advertising Platform for Marketers