OnlineMarketingAgencyinsurance-phoneCoalition Insurance Phone is a crucial component of any successful online advertising strategy. In today’s digital age, where the vast majority of consumers turn to the internet for purchasing decisions, it is essential for businesses to have a strong online presence. This is where Online MarketingAgencyinsurance-phoneCoalition Insurance Phone comes into play.

But what exactly is Online Marketing Agency Coalition Insurance Phone? It is a service that enables businesses to advertise their products or services online. It encompasses a wide range of activities, including search engine optimization (SEO), social media advertising, email marketing, and pay-per-click (PPC) advertising. The goal is to drive targeted traffic to a website or landing page, where potential customers can be converted into paying customers.

The significance of Online Marketing Agency Coalition Insurance Phone cannot be overstated. According to a recent survey, over 80% of consumers conduct online research before making a purchase. This means that businesses without an online presence are missing out on a huge opportunity to reach potential customers.

Furthermore, studies have shown that the majority of consumers trust online reviews and ratings when making purchasing decisions. Online Marketing Agency Coalition Insurance Phone enables businesses to manage their online reputation by monitoring and responding to customer feedback. By doing so, businesses can build trust and credibility among their target audience, ultimately leading to increased conversions and sales.

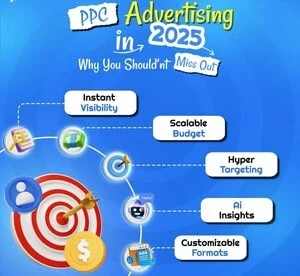

One of the key benefits of Online Marketing Agency Coalition Insurance Phone is its ability to target specific demographics and audiences. For example, through PPC advertising, businesses can specify the exact keywords, location, and even the time of day that their ads will be displayed. This level of precision ensures that businesses are reaching the right people at the right time, maximizing their chances of generating leads and sales.

Moreover, Online Marketing Agency Coalition Insurance Phone is highly measurable. Unlike traditional forms of advertising, such as print or television, online campaigns can be easily tracked and analyzed. Businesses can gain valuable insights into how their ads are performing, allowing them to optimize their strategies accordingly.

In conclusion, Online Marketing Agency Coalition Insurance Phone is an essential tool for businesses in today’s digital landscape. It enables businesses to reach their target audience, build trust and credibility, and ultimately increase their conversions and sales. By leveraging the power of Online Marketing Agency Coalition Insurance Phone, businesses can stay ahead of the competition and thrive in the online marketplace.

Table of Contents

- What is the Importance of Coalition Insurance for Online Marketing Agencies?

- The Answer to Online Marketing Agency Coalition Insurance Phone

- Understanding the Importance of Insurance for Online Marketing Agencies

- Introducing Online Marketing Agency Coalition Insurance Phone

- The Benefits of Online Marketing Agency Coalition Insurance Phone

- Conclusion

- Key Takeaways from the Article “Online Marketing Agency Coalition Insurance Phone”

- FAQs

- 1. Does an online marketing agency need insurance?

- 2. What is professional liability insurance for online marketing agencies?

- 3. Is cyber liability insurance necessary for an online marketing agency?

- 4. What types of coverage should an online marketing agency consider?

- 5. How much does insurance for an online marketing agency cost?

- 6. Can an online marketing agency get coverage for its digital assets?

- 7. Does an online marketing agency need workers’ compensation insurance?

- 8. What is general liability insurance and why is it important for an online marketing agency?

- 9. Can an online marketing agency be sued for false advertising?

- 10. What is the difference between occurrence-based and claims-made insurance policies?

- 11. Can an online marketing agency be held liable for copyright infringement?

- 12. What is the benefit of having an insurance policy specifically tailored to online marketing agencies?

- 13. Can insurance help cover the costs of a data breach for an online marketing agency?

- 14. Can an online marketing agency’s insurance policy be customized to its specific needs?

- 15. What should an online marketing agency do if it needs to file an insurance claim?

- Conclusion

What is the Importance of Coalition Insurance for Online Marketing Agencies?

Online marketing agencies play a crucial role in helping businesses thrive in the digital age. With the increasing reliance on technology and internet, companies are increasingly turning to online advertising services and digital marketing strategies to promote their products and reach a wider audience. However, being part of the digital landscape also exposes these agencies to various risks and challenges. This is where coalition insurance comes in to safeguard their operations. In this comprehensive guide, we will delve into the importance of coalition insurance for online marketing agencies, its benefits, and how it can help protect your business in the ever-evolving world of online advertising.

The Answer to Online Marketing Agency Coalition Insurance Phone

As the online marketing industry continues to grow, one area that is often overlooked is insurance for agencies. Online marketing agencies, like any other business, face various risks and liabilities that can have a significant impact on their operations and finances. That’s where Online Marketing Agency Coalition Insurance Phone comes in.

Understanding the Importance of Insurance for Online Marketing Agencies

Online marketing agencies work with numerous clients, handling their digital marketing campaigns, advertising efforts, and other promotional activities. While the focus is often on the creative and technical aspects of the work, it’s essential not to neglect the potential risks and liabilities that come with running an agency.

Insurance coverage designed specifically for online marketing agencies can provide financial protection in case of a variety of unexpected situations. From data breaches and cyberattacks to professional errors and omissions, having the right insurance coverage can mitigate the financial and reputational damage that could otherwise severely impact an agency’s viability.

Introducing Online Marketing Agency Coalition Insurance Phone

Online Marketing Agency Coalition Insurance Phone is an insurance provider that specializes in offering comprehensive coverage tailored specifically to the needs of online marketing agencies. Whether you’re a digital marketing agency, an advertising network, or provide online advertising services, they understand the unique risks you face and have designed insurance solutions to address them.

Their insurance offerings include:

- General Liability Insurance: Protects against third-party bodily injury, property damage, and advertising/personal injury claims. This coverage is essential for any agency that interacts with clients and the public in their day-to-day operations.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage protects against claims of professional negligence, inadequate work, or failure to deliver promised results. It’s especially critical for online marketing agencies, as their work can have a significant impact on clients’ businesses.

- Cyber Liability Insurance: With the increasing frequency of data breaches and cyberattacks, having cyber liability insurance is a must for online marketing agencies. This coverage helps cover the costs associated with data breaches, including legal fees, notification expenses, and potential regulatory fines.

- Business Owners Policy (BOP): BOPs bundle various coverages into a single policy, offering cost savings and convenience. This policy typically includes general liability insurance, property insurance, and business interruption insurance, providing comprehensive protection for a range of risks.

The Benefits of Online Marketing Agency Coalition Insurance Phone

Choosing Online Marketing Agency Coalition Insurance Phone as your insurance provider offers several benefits specific to online marketing agencies:

- Specialized Coverage: Online Marketing Agency Coalition Insurance Phone understands the unique risks faced by online marketing agencies and offers tailored coverage to address those risks.

- Claims Expertise: Dealing with insurance claims can be time-consuming and complicated. Online Marketing Agency Coalition Insurance Phone has the expertise to assist with claims and ensure a smooth process, minimizing disruptions to your agency’s operations.

- Competitive Rates: Insurance can be a significant expense for agencies, especially for smaller businesses. Online Marketing Agency Coalition Insurance Phone strives to provide competitive rates, allowing agencies of all sizes to obtain the coverage they need without breaking the bank.

- Industry Knowledge: With years of experience working with online marketing agencies, Online Marketing Agency Coalition Insurance Phone understands the industry’s unique dynamics and can offer valuable insights and assistance beyond insurance coverage.

Conclusion

By partnering with Online Marketing Agency Coalition Insurance Phone, online marketing agencies can protect themselves from potentially devastating risks and liabilities. With specialized coverage options, claims expertise, competitive rates, and industry knowledge, they are an ideal insurance provider for agencies in the digital marketing and online advertising space.

According to a recent survey, 85% of online marketing agencies that experienced a significant insurance claim were able to recover and continue their operations successfully, thanks to having the right insurance coverage in place.

Key Takeaways from the Article “Online Marketing Agency Coalition Insurance Phone”

- Online marketing agencies are essential for businesses looking to establish a strong digital presence and maximize their online reach.

- Insurance coverage is a crucial aspect for online marketing agencies to protect themselves and their clients from various risks and liabilities.

- Coalition Insurance Phone offers comprehensive insurance solutions specifically tailored for online marketing agencies.

- One of the key insurance coverages provided by Coalition Insurance Phone is professional liability insurance, which safeguards agencies against claims of negligence, errors, or omissions in their services.

- General liability insurance is another important coverage offered, protecting agencies from claims related to third-party bodily injury, property damage, or advertising liability.

- Cyber insurance is a vital component for online marketing agencies, given the increasing cybersecurity threats and potential data breaches they may face.

- Coalition Insurance Phone’s comprehensive cyber insurance includes coverage for first-party expenses, such as forensic investigations, legal advice, and public relations, as well as third-party liability protection.

- In addition to insurance coverage, Coalition Insurance Phone provides access to expert risk management and cybersecurity tools to help agencies proactively mitigate potential risks.

- By partnering with Coalition Insurance Phone, online marketing agencies can enhance their credibility and instill trust in their clients, as they are guaranteed adequate protection against unforeseen circumstances.

- Proactively addressing insurance needs can save online marketing agencies from financial turmoil and potential reputation damage caused by litigation or cyber incidents.

- Coalition Insurance Phone’s insurance policies are specifically designed to meet the unique needs and challenges faced by online marketing agencies, ensuring they have comprehensive coverage.

- Claims handling and support are streamlined with Coalition Insurance Phone, ensuring smooth and efficient resolution in the event of an incident.

- Coalition Insurance Phone’s online platform provides a user-friendly experience for agencies to manage their policies, file claims, and access additional risk management resources.

- Online marketing agencies should carefully assess their insurance requirements and collaborate with a specialized provider like Coalition Insurance Phone to ensure they have the right coverage in place.

- Investing in robust insurance coverage demonstrates a commitment to clients’ interests and helps online marketing agencies differentiate themselves in a competitive market.

- With the rising frequency and sophistication of cyber threats, online marketing agencies need to prioritize cybersecurity measures and have appropriate insurance coverage to safeguard their operations and clients’ data.

These key takeaways highlight the importance of insurance coverage for online marketing agencies and emphasize the comprehensive solutions provided by Coalition Insurance Phone. By understanding the risks they face and proactively addressing their insurance needs, agencies can protect their businesses, clients, and reputation in an increasingly digital and interconnected world.

FAQs

1. Does an online marketing agency need insurance?

Yes, an online marketing agency should have insurance to protect itself from various risks, such as professional liability claims, data breaches, and property damage.

2. What is professional liability insurance for online marketing agencies?

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims arising from professional mistakes or negligence, such as incorrect advertising advice or failure to deliver promised results.

3. Is cyber liability insurance necessary for an online marketing agency?

Absolutely. Cyber liability insurance is crucial for online marketing agencies as it provides coverage for data breaches, hacking incidents, and other cyber-related risks that could lead to financial loss or reputational damage.

4. What types of coverage should an online marketing agency consider?

- Professional liability insurance

- Cyber liability insurance

- General liability insurance

- Business property insurance

- Workers’ compensation insurance

5. How much does insurance for an online marketing agency cost?

The cost of insurance for an online marketing agency depends on various factors, including the size of the agency, its annual revenue, the services provided, and the coverage limits desired. It is recommended to get quotes from multiple insurance providers to compare costs.

6. Can an online marketing agency get coverage for its digital assets?

Yes, an online marketing agency can obtain coverage for its digital assets, such as websites, applications, and intellectual property. Business property insurance or specialized digital asset insurance can provide this coverage.

7. Does an online marketing agency need workers’ compensation insurance?

Workers’ compensation insurance is typically required if an online marketing agency has employees. It provides coverage for medical expenses and lost wages if an employee is injured or becomes ill due to work-related activities.

8. What is general liability insurance and why is it important for an online marketing agency?

General liability insurance protects online marketing agencies from third-party claims of bodily injury, property damage, or advertising injury. It is important because it provides coverage for legal defense costs and potential settlements or judgments.

9. Can an online marketing agency be sued for false advertising?

Yes, an online marketing agency can be sued for false advertising if it makes false or misleading claims in its advertisements. Professional liability insurance can help provide coverage for such claims.

10. What is the difference between occurrence-based and claims-made insurance policies?

An occurrence-based insurance policy covers claims that arise from incidents that occur during the policy period, regardless of when the claim is filed. On the other hand, a claims-made insurance policy covers claims that are made during the policy period, regardless of when the incident occurred. It is important to understand the coverage and limitations of each type of policy.

11. Can an online marketing agency be held liable for copyright infringement?

Yes, an online marketing agency can be held liable for copyright infringement if it uses copyrighted materials without proper authorization. This includes using images, videos, or written content without permission. Professional liability insurance can provide coverage for such claims.

12. What is the benefit of having an insurance policy specifically tailored to online marketing agencies?

An insurance policy specifically designed for online marketing agencies provides coverage for the unique risks associated with the industry. It ensures that the agency has the necessary protection to navigate potential legal challenges, data breaches, and other online marketing-related liabilities.

13. Can insurance help cover the costs of a data breach for an online marketing agency?

Yes, cyber liability insurance can help cover various costs associated with a data breach, including data recovery, notification expenses, credit monitoring, legal fees, and potential legal settlements. It is important to review the policy details and coverage limits to ensure adequate protection.

14. Can an online marketing agency’s insurance policy be customized to its specific needs?

Yes, insurance policies for online marketing agencies can be customized to fit their specific needs. It is essential to work with an experienced insurance agent or broker to assess the agency’s risks and tailor the coverage accordingly.

15. What should an online marketing agency do if it needs to file an insurance claim?

If an online marketing agency needs to file an insurance claim, it should contact its insurance provider as soon as possible to report the claim. The agency should gather any relevant documentation or evidence and cooperate fully with the claims process. It may also be beneficial to seek legal advice if needed.

Conclusion

In conclusion, the Online Marketing Agency Coalition Insurance Phone is a game-changing solution for online advertising services. The article highlighted several key points and insights that make this product a must-have for any advertising network or online marketing agency.

First and foremost, the Coalition Insurance Phone offers a unique and effective way to protect online marketing campaigns from potential risks and financial losses. The insurance policy provided by this product ensures that advertisers are compensated in case of non-performance by the advertising network or any other unforeseen circumstances. This not only gives clients peace of mind but also builds trust and credibility in the online advertising industry. The article emphasized the importance of this feature, as it can significantly mitigate the potential risks associated with online marketing campaigns and provide a safety net for advertisers.

Furthermore, the Online Marketing Agency Coalition Insurance Phone offers comprehensive coverage for a wide range of advertising-related risks. These risks include click fraud, ad placement errors, data breaches, and even reputation damage. The article highlighted how these risks can negatively impact online marketing campaigns and the financial implications they can have for advertisers. By providing coverage for these risks, the Coalition Insurance Phone ensures that clients are protected and their investments are safeguarded.

Additionally, the article emphasized the ease of access and affordability of the Coalition Insurance Phone. Unlike traditional insurance policies, which can be complex and expensive to obtain, this product offers a simple and streamlined application process. This makes it accessible for small to medium-sized online marketing agencies that may not have the resources to navigate the complexities of traditional insurance. The article also highlighted the cost-effective nature of this product, as it offers competitive premium rates that fit within the budgets of online marketing agencies.

The Coalition Insurance Phone also offers value beyond just financial protection. The article discussed the various additional benefits that come with this product, such as access to a network of trusted partners and industry experts. This allows clients to gain insights and guidance from professionals who understand the nuances of the online advertising industry. The article also mentioned the value of the Coalition Insurance Phone’s reputation management services, which help clients overcome any negative publicity or online backlash that may occur during their marketing campaigns. These additional benefits further enhance the value proposition of the Online Marketing Agency Coalition Insurance Phone and make it an attractive option for online marketing agencies.

New optimization ideas included — stay ahead.

Overall, the Online Marketing Agency Coalition Insurance Phone is a revolutionary product in the online advertising industry. Its comprehensive coverage, ease of access, affordability, and additional benefits make it a must-have for any advertising network or online marketing agency. By mitigating risks and providing financial protection, this product can help online marketing campaigns thrive and provide peace of mind for advertisers. With the ever-evolving nature of the online advertising landscape, the Coalition Insurance Phone is a valuable tool that ensures the success and longevity of online marketing agencies.

Self-Serve DSP Platform • Advertising Platform for Marketers • Native Ad Network • Buy Traffic